GST 2.0 has been revealed. The new two-slab structure has been approved.

No GST on individual health insurance policies,the Finance Minister said.This announcement followed a long 56th meeting of the GST Council.

No GST on individual health insurance policies, the Finance Minister said. This announcement followed a long 56th meeting of the GST Council, which lasted 10.5 hours. During this meeting, the Centre and states discussed key tax proposals.

GST Council Meeting 2025

The Goods and Services Tax (GST) Council held its 56th meeting on Wednesday, lasting over 10 hours. The council approved new reforms in the eight-year-old indirect tax system. This creates a broad two-slab structure of 5 percent and 18 percent, with a higher rate of 40 percent for super luxury, sin, and demerit goods.

The Aim

is to reduce the tax burden on ordinary people by making significant cuts to tax rates and lowering GST slabs. It also seeks to unlock blocked working capital and improve the ease of doing business through automated refunds and a simpler registration process.

All the rate changes, except for tobacco and tobacco-related products, will take effect on September 22, the first day of Navratri. This was stated by Union Finance Minister Nirmala Sitharaman, who led the meeting attended by ministers from 31 states and Union Territories.

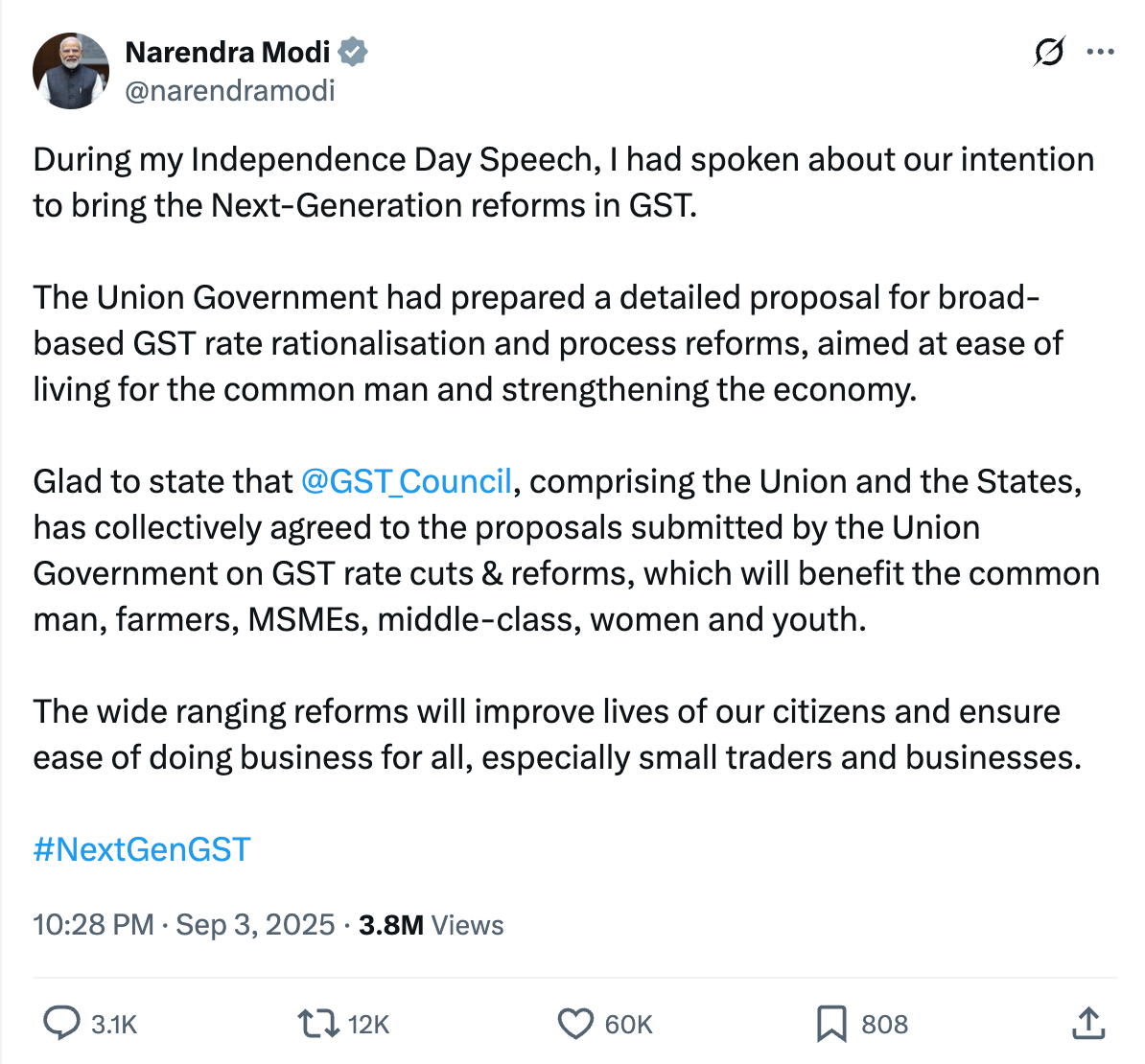

PM Modi welcomes the GST council's approval of reforms. He states that this decision will help both citizens and businesses.

Prime Minister Narendra Modi said he was pleased that the GST Council, which includes the Union and the States, agreed to the proposals from the Union Government. These proposals involve GST rate cuts and reforms that will help the common man, farmers, MSMEs, middle class, women, and youth.

“The wide ranging reforms will improve the lives of our citizens and ensure ease of doing business for all, especially small traders and businesses,” Modi said.

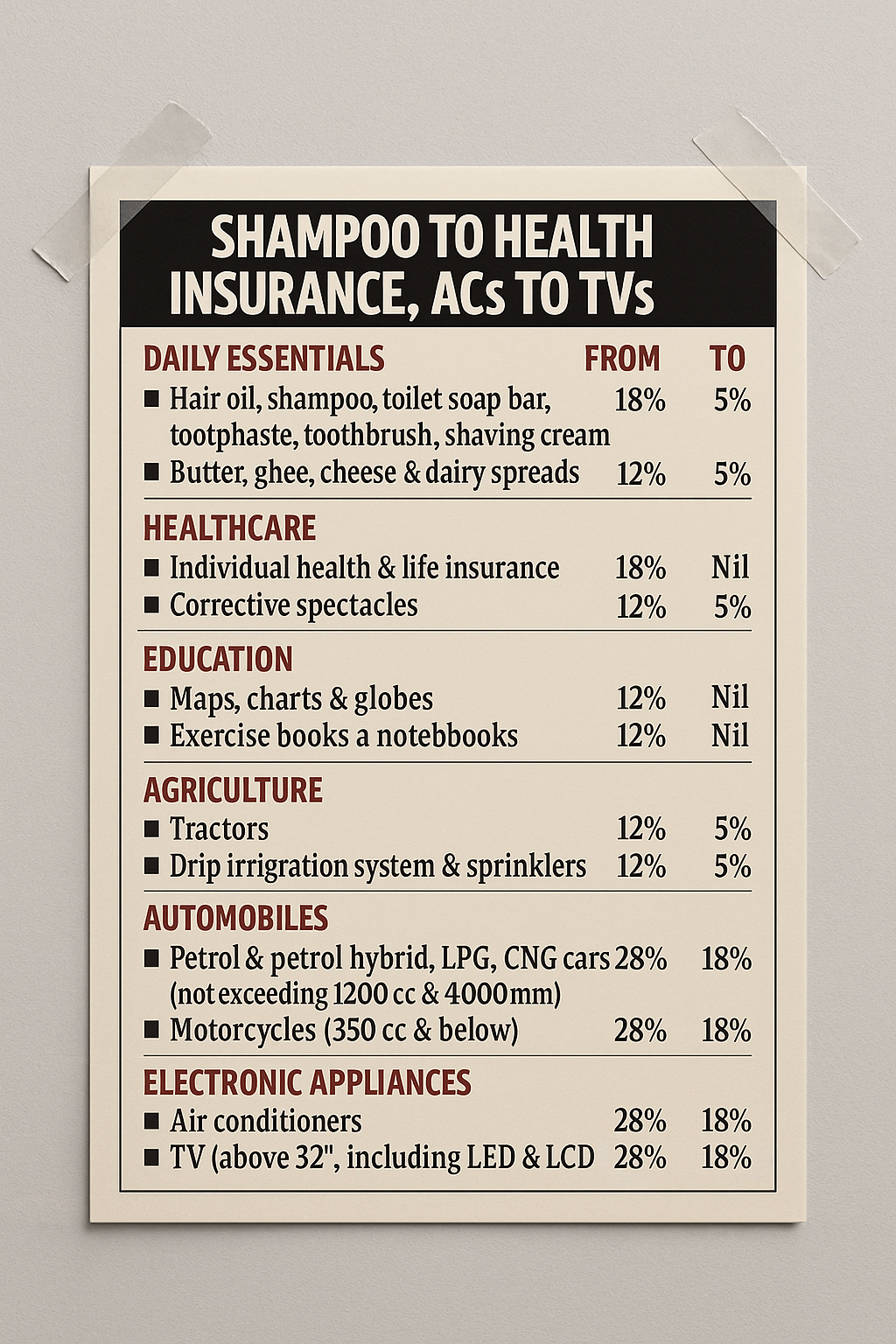

The GST Council announced significant rate cuts for everyday items. This includes packaged and branded food such as fruit juices, butter, cheese, condensed milk, pasta, packaged coconut water, soya milk drinks, nuts, dates, and sausages. Medical items will also see changes, with a drop from 12 percent to 5 percent for medical grade oxygen, gauze, bandages, and diagnostic kits. Additionally, there will be a zero GST rate for ultra-high temperature milk, chhena or paneer, pizza bread, khakra, plain chapati or roti, and erasers in education, which will decrease from 5 percent.

Other common items that have also had GST reduced to 5 per cent from either 12 per cent or 18 per cent include hair oil, soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware, and other household articles.

GST has been reduced for white goods like air conditioners, television sets, and dishwashing machines to 18 percent from 28 percent. Small cars with an engine capacity not exceeding 1200 cc (petrol) and 1500 cc (diesel), and with a length not over 4 meters will now fall under the 18 percent category. There will also be tax relief for motorcycles with an engine capacity less than 350 cc and for all automotive parts, which will now be taxed at 18 percent. Bigger cars will be taxed at 40 percent. The GST rate on all electric vehicles will stay the same at 5 percent.

Other common items that have also had GST cut to 5 percent from either 12 percent or 18 percent include hair oil, soap bars, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware, and other household goods.

GST for white goods like air conditioners, television sets, and dishwashing machines has been lowered to 18 percent from 28 percent. Small cars with engine capacities of up to 1200 cc for petrol and 1500 cc for diesel, as well as those not exceeding 4 meters in length, will also fall under the 18 percent rate. Motorcycles with engine capacities below 350 cc and all automotive parts will be taxed at 18 percent too. Larger cars will face a tax rate of 40 percent. The GST rate for all electric vehicles will stay the same at 5 percent.

Another key decision involved the blanket exemption for life insurance, including term insurance, ULIPs, and endowment policies for individuals. There is also an exemption for health insurance for individuals, which includes family floater plans and policies for senior citizens. Services that support beauty and physical well-being, such as gyms, salons, barbers, and yoga centers, will now have a lower GST of 5 percent instead of the current 18 percent.

With these changes, the GST will remove the multiple tax rates of 5 percent, 12 percent, 18 percent, and 28 percent. It will adopt a simpler two-slab structure with a reduced rate of 5 percent and a standard rate of 18 percent. Additionally, there will be a special high rate of 40 percent for luxury, harmful, and demerit goods such as pan masala, tobacco, and cigarettes.

Beyond Rates: GST Reforms Put Common Man & Businesses First

Another important decision was about the blanket exemption for life insurance. This includes term life, ULIPs, and endowment policies for individuals, as well as health insurance for individuals, family floater plans, and policies for senior citizens. Services related to beauty and physical well-being, such as gyms, salons, barbers, and yoga centers, will now have a lower GST of 5 percent instead of the current 18 percent.

With these reforms, GST will eliminate the multiple tax rates of 5 percent, 12 percent, 18 percent, and 28 percent. It will simplify the system to a clear two-slab structure: a reduced rate of 5 percent and a standard rate of 18 percent. There will also be a special high rate of 40 percent for super luxury, sin, and harmful goods like pan masala, tobacco, and cigarettes.

The simplification of slabs will help fix the inverted duty structure, where the tax rate on output supply is lower than the tax rate on inputs. This issue has been impacting the working capital and cash flow of businesses. It will also address many classification disputes that have arisen from having multiple rates and different rates for similar items, especially in the automotive and food sectors.

“The Prime Minister set the stage for the next generation of reforms on August 15 when he spoke from the Red Fort. This reform isn’t just about adjusting rates; it’s also about structural changes. It aims to improve the ease of living so businesses can operate smoothly with GST. We have addressed the problems with the inverted duty structure, sorted out classification issues, and ensured more stability and predictability with GST. We have reduced the number of slabs to just two and are also dealing with the issues surrounding the compensation cess,” Sitharaman told reporters after the meeting.

She noted that these reforms focus on the common person. “Every tax on daily items used by the common man has been carefully examined. In most cases, the rates have significantly decreased. Labour-intensive industries have received strong support. Farmers and the agriculture sector will also gain from the decisions made today, along with health-related sectors. So, the vital parts of the economy have been prioritized,” she said.

Addressing the tariffs imposed on India by the US, Sitharaman stated, “The tariff issue did not affect the GST reform. We have been working on this for more than a year and a half. One Group of Ministers worked on rate adjustment while another group later focused on insurance, among other things. Compensation cess was a reality intended to end once the loans were paid back. None of this relates to the tariffs.”

Council Chooses People Over Politics in GST Reset

States have expressed concerns about revenue loss in the meeting, estimating it to be between Rs 80,000 crore and Rs 1.5 lakh crore. Some states brought up the option of voting on certain issues during the Council meeting. However, in the end, no votes took place. Instead, the decision was made by consensus in the spirit of implementing the proposal that benefits the public, officials said.

Revenue Secretary Arvind Shrivastava stated that the proposal is “fiscally sustainable” and is expected to have a net revenue impact of Rs 48,000 crore. “We have estimated a figure. We expect the net fiscal impact—not to be called revenue loss, as that doesn’t seem right—to be around Rs 48,000 crore. This is based on the consumption data from 2023-24, where we gathered all the detailed information,” he said.

The long-awaited correction of the inverted duty structure has also been made for the textiles and fertiliser sectors. GST cuts were announced for the manmade textile sector, reducing the tax rate on manmade fibre from 18 percent to 5 percent and on manmade yarn from 12 percent to 5 percent. In the fertiliser sector, GST on inputs like sulphuric acid, nitric acid, and ammonia has been cut from 18 percent to 5 percent.

The industry welcomed the GST rate adjustments and other reforms, promising to pass on the benefits of the rate cuts to the general public.

Comments ()